Letter from the President

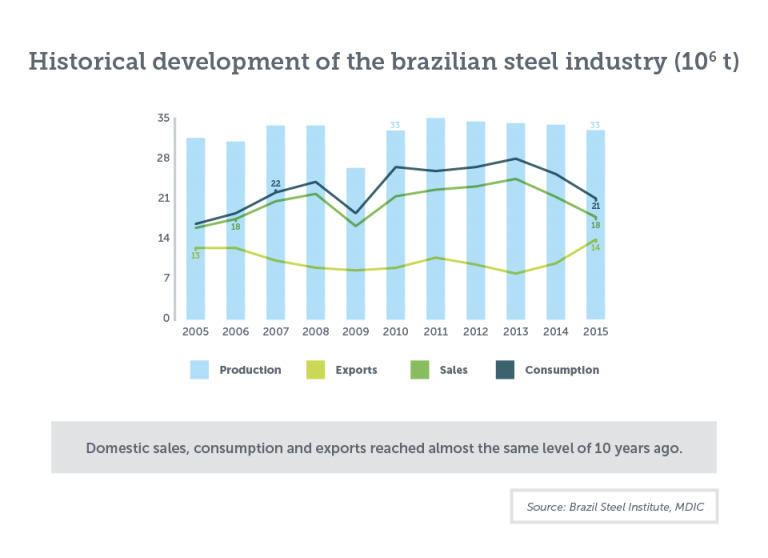

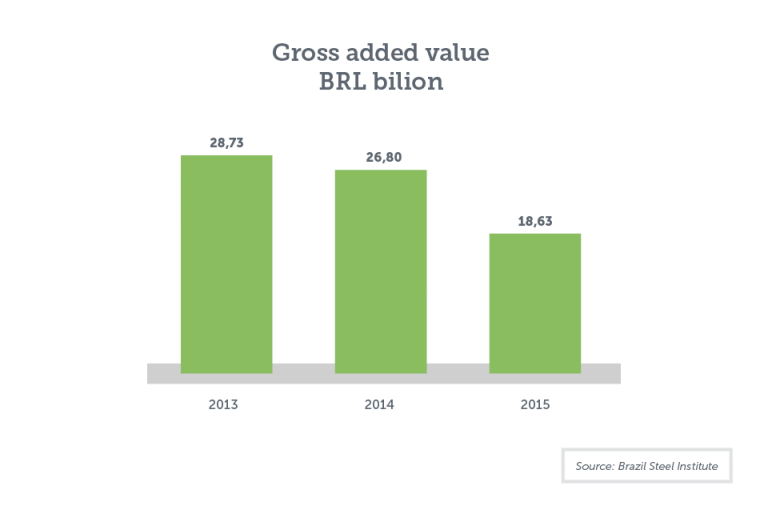

This is the 10th edition of the Sustainability Report about the Brazilian steel industry. It includes efforts and indicators of such industry for years 2014 and 2015, connected to economic, social and environmental aspects. In keeping with the transparency that has always guided the relationship between Brazil Steel Institute, its member companies and stakeholders; we show that the 2014-2015 two-year span was not positive for the industry, as a result of the severe political and economic crises that shook Brazil over the past few years.

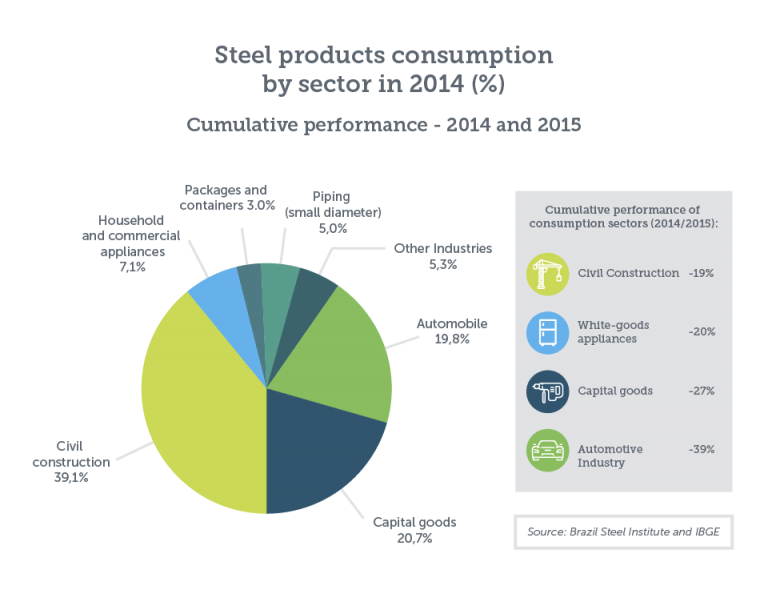

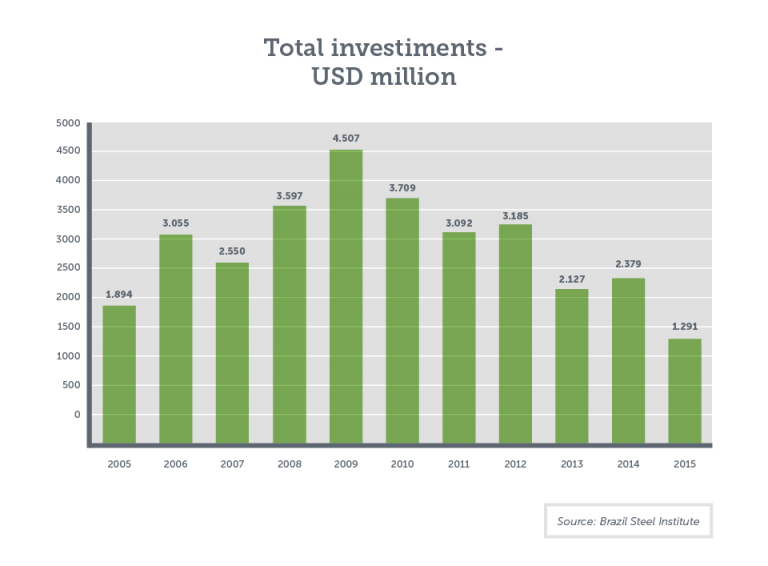

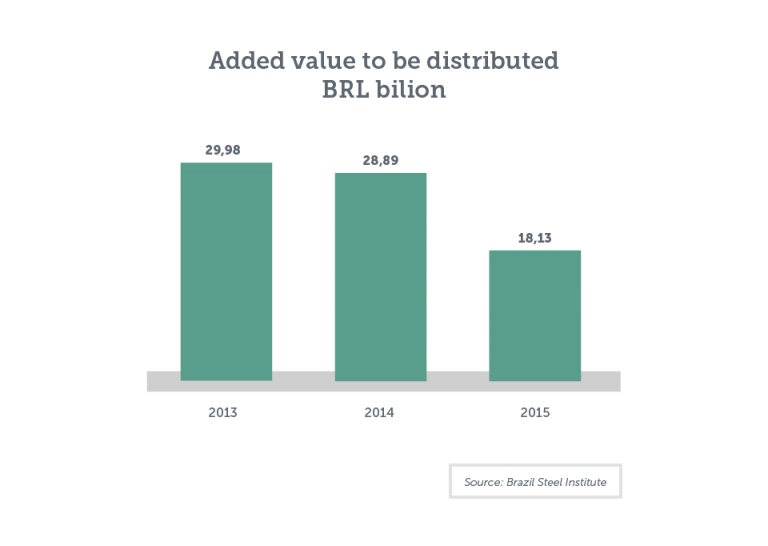

Factors such as GDP, high tax burden, decrease of investment grade and interest, the latter having achieved skyrocketing thresholds, in addition to the political crisis, brought on a decrease in the level of investments and reduced consumption figures. Consequently, the industrial activity was the second most impacted business area since the crisis’ onset. Civil construction and the machinery and equipment and automobile industries, which account for around 80% of the steel consumption in Brazil, underwent a significant drop in sales, thus directly impacting the domestic steel production industry.

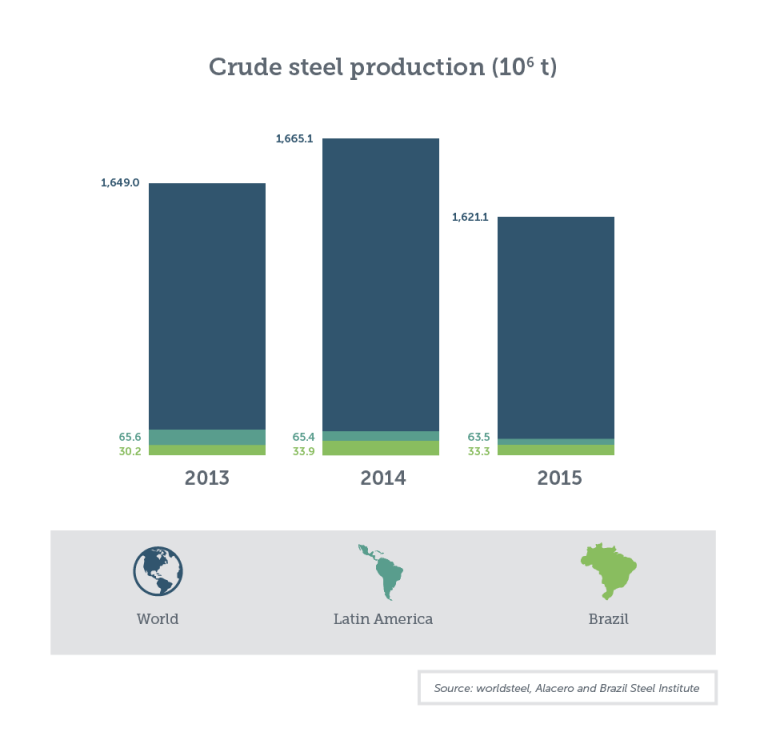

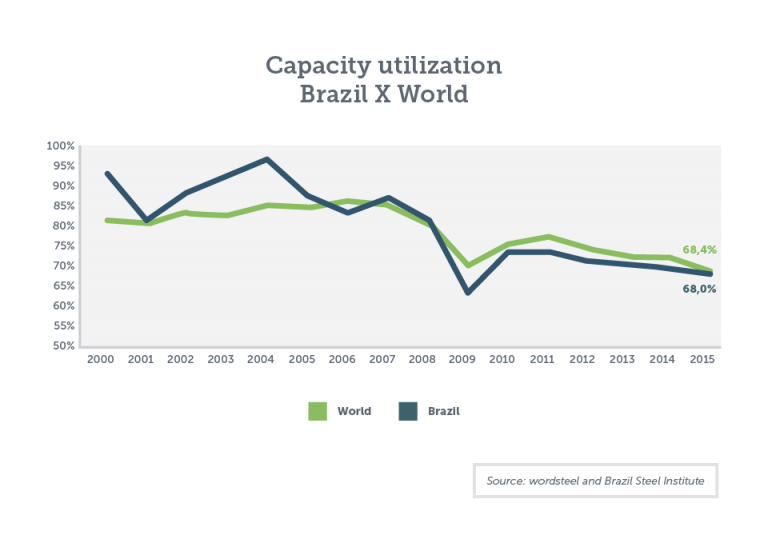

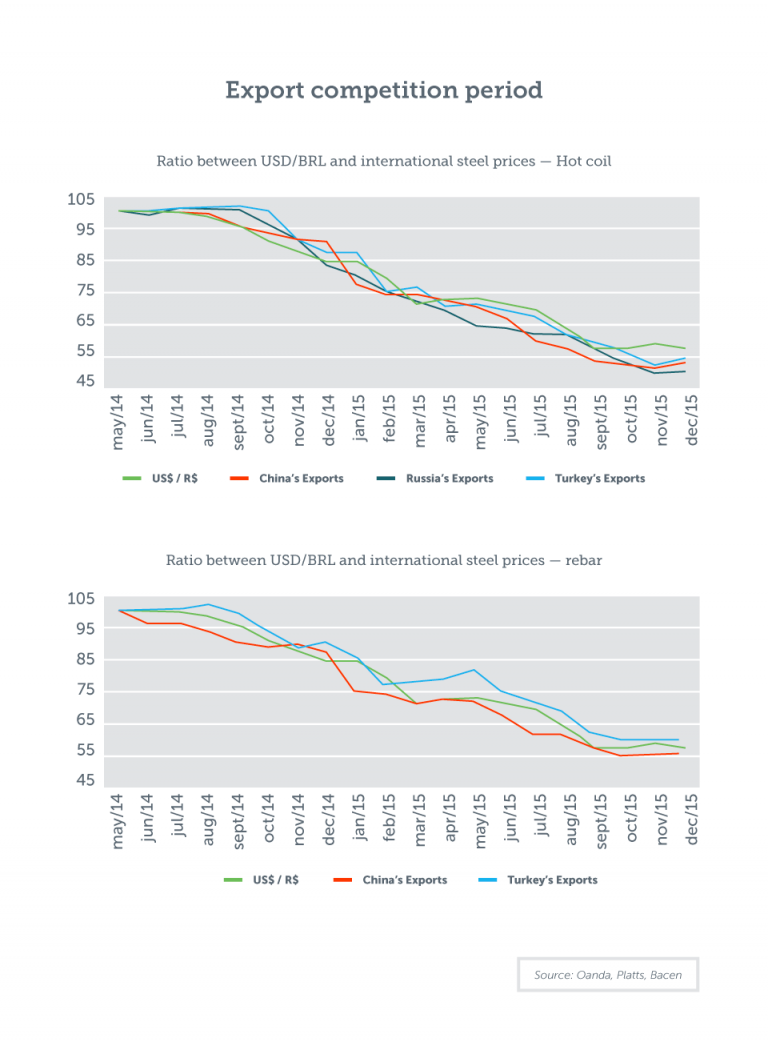

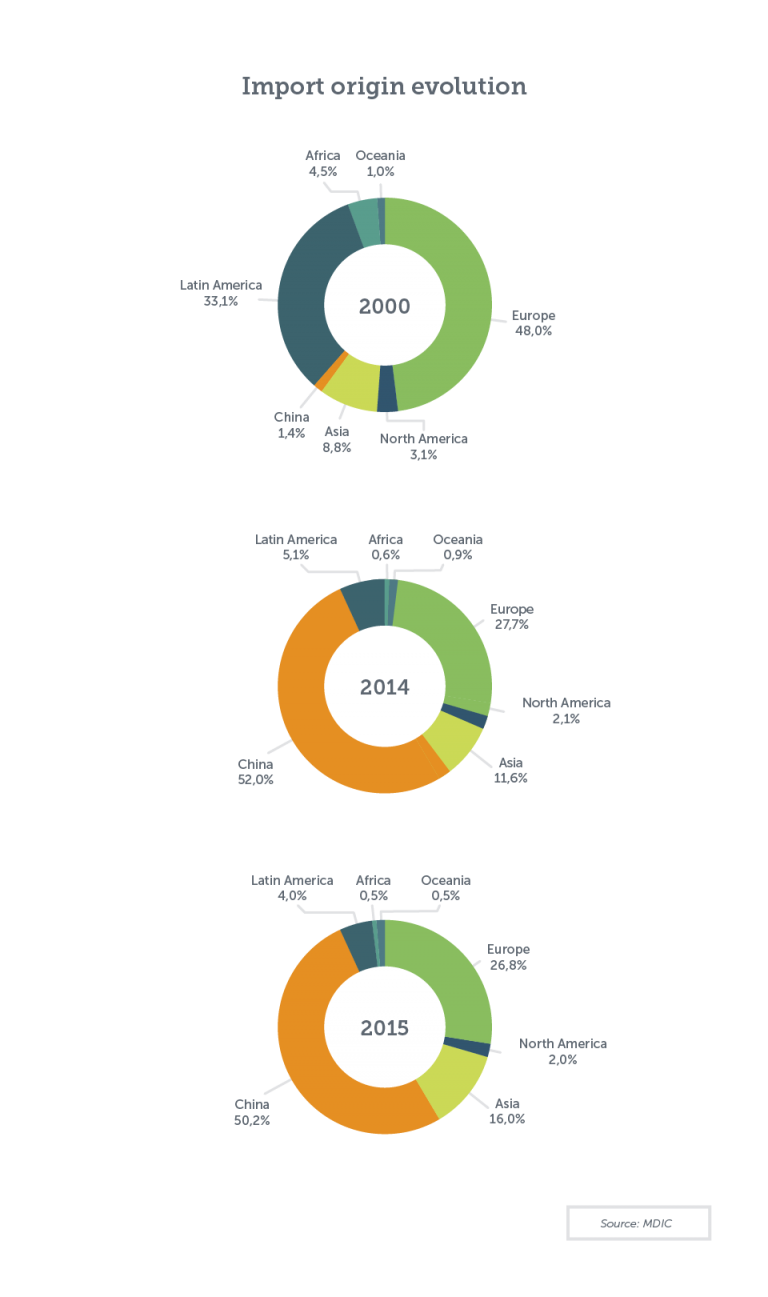

The steel industry also faces the aggravating international scenario, where there is surplus production capacity amounting to 700 million tons of steel, mostly coming from China.

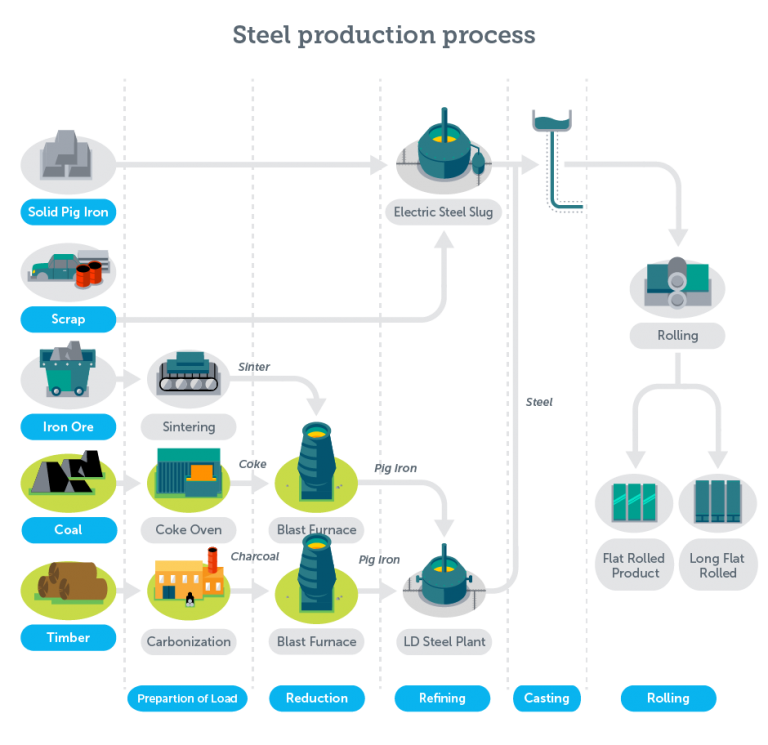

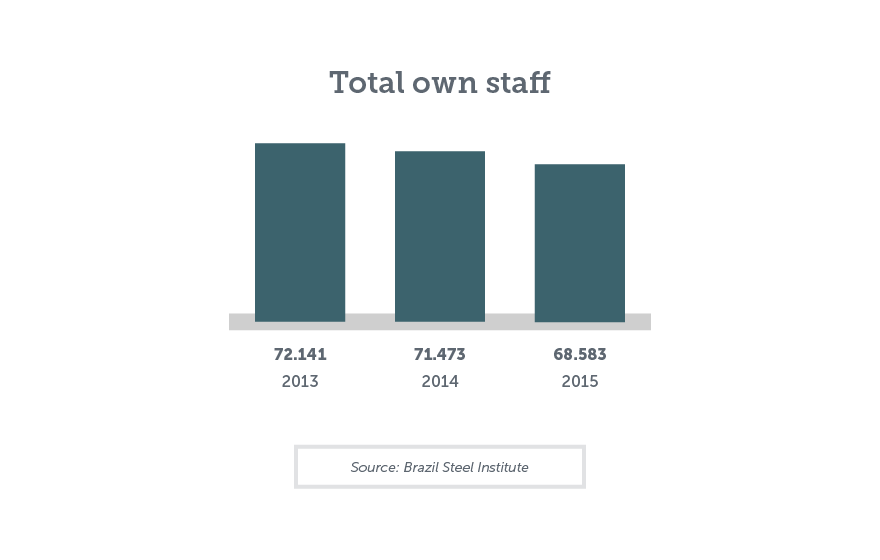

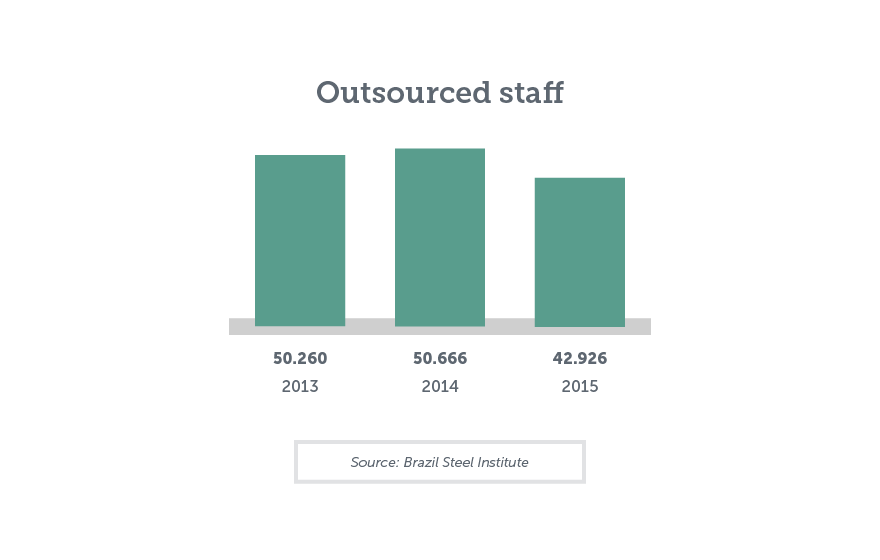

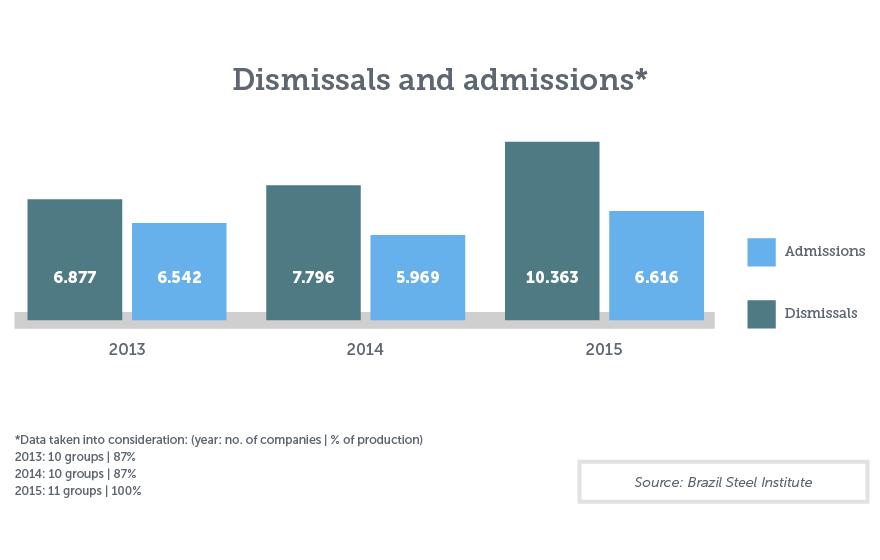

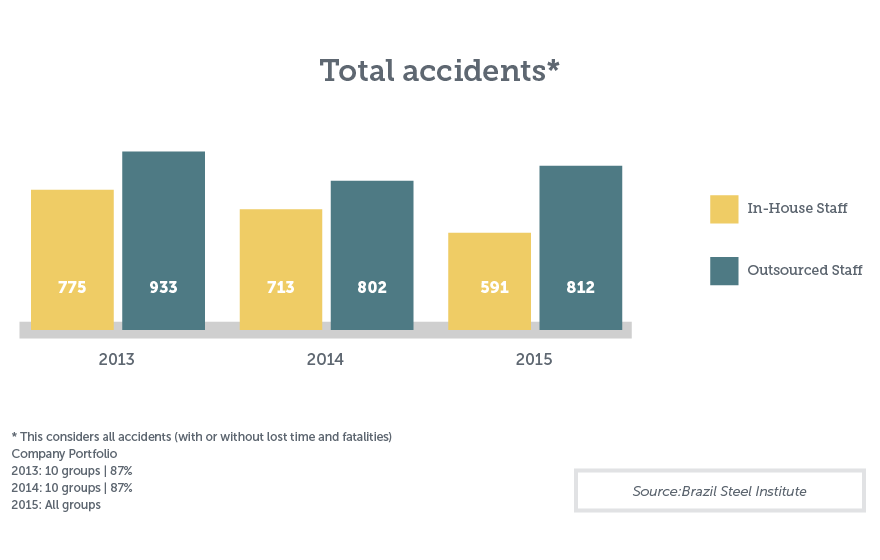

The combination of the domestic market shrinkage with the tough worldwide competition led the Brazilian steel plants to a halt, causing the shutdown or closing of production units, as well as eliminated job vacancies. Since January 2014, 29,740 industry workers were laid off and 2,296 contracts were terminated. Within the same period, 74 units were decommissioned or shut down, including 4 blast furnaces, 8 steel plants, 15 rolling mills, 5 mining units, 1 coking plant and 1 sintering plant, among others.

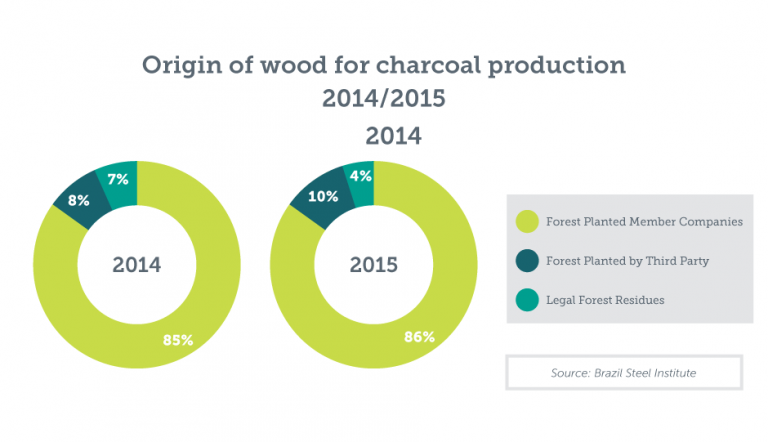

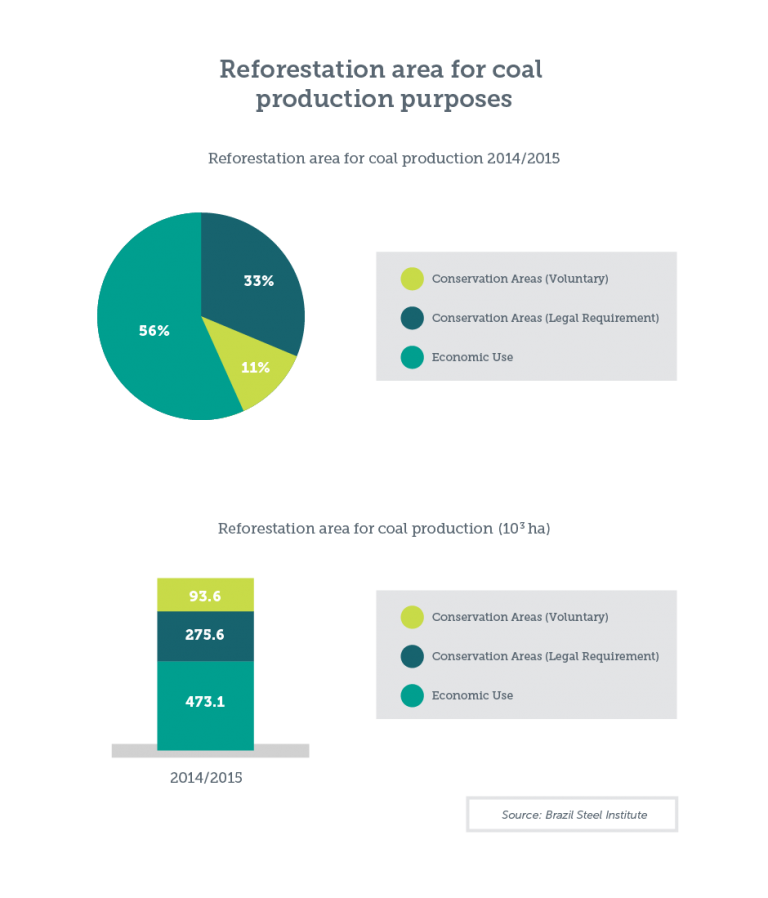

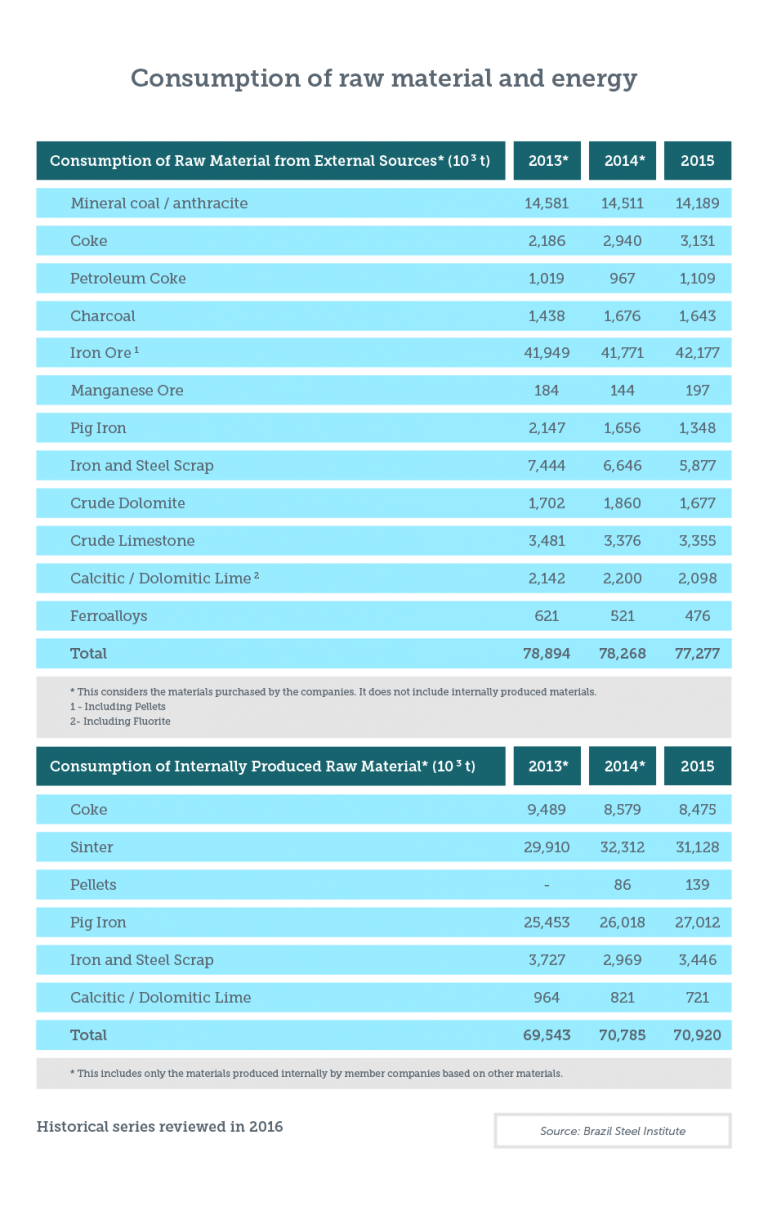

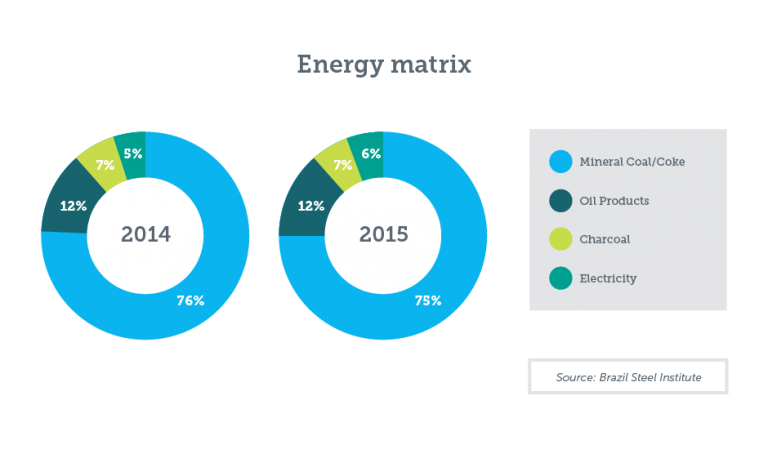

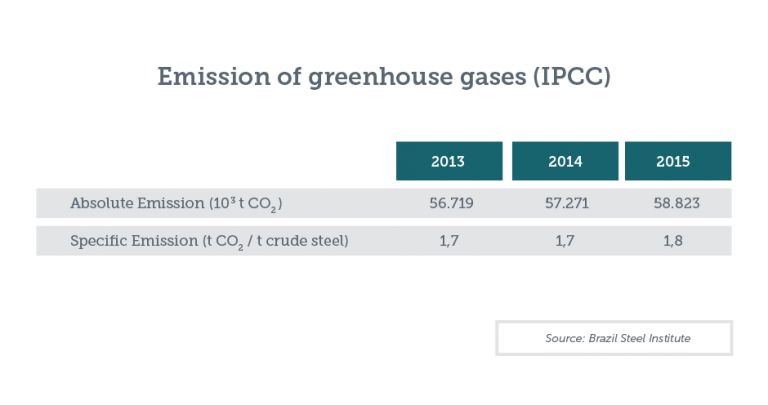

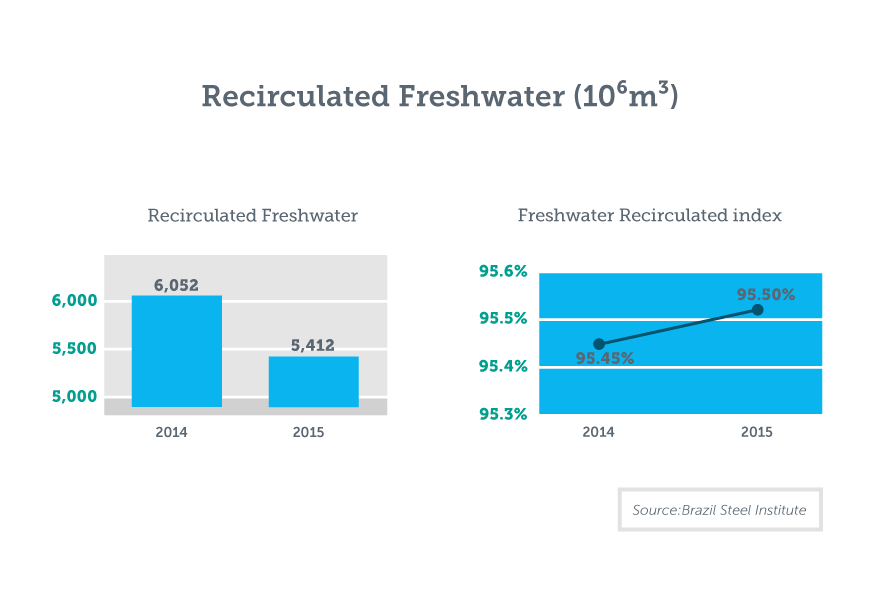

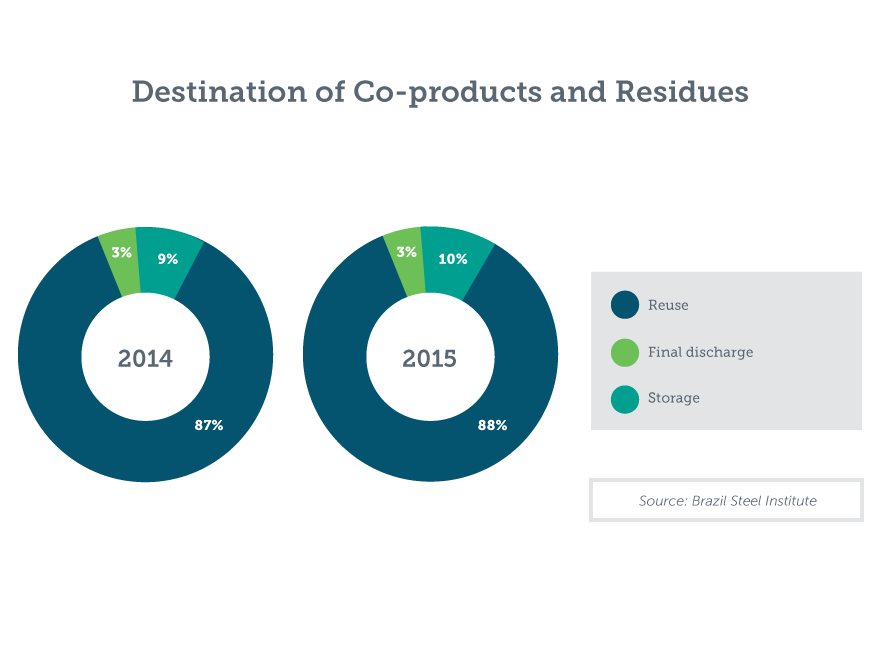

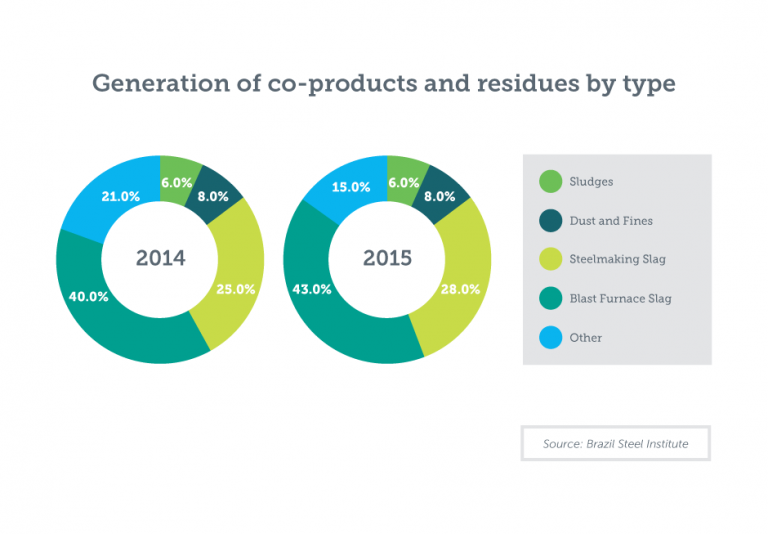

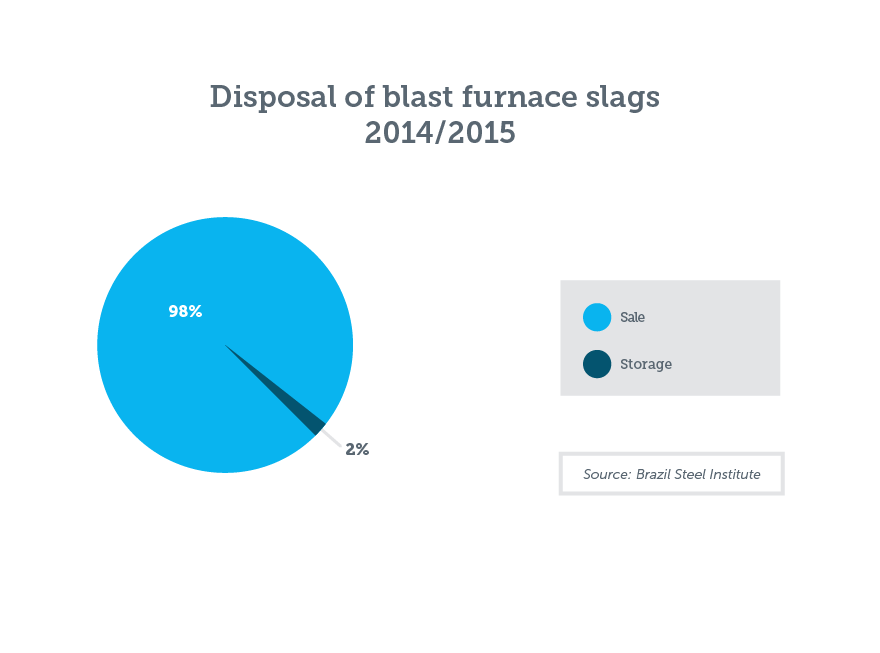

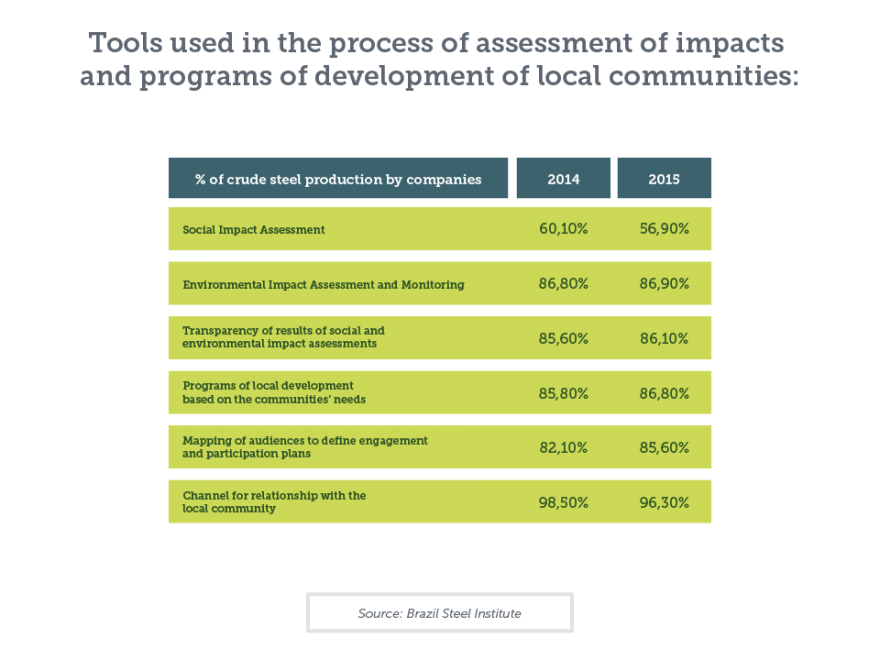

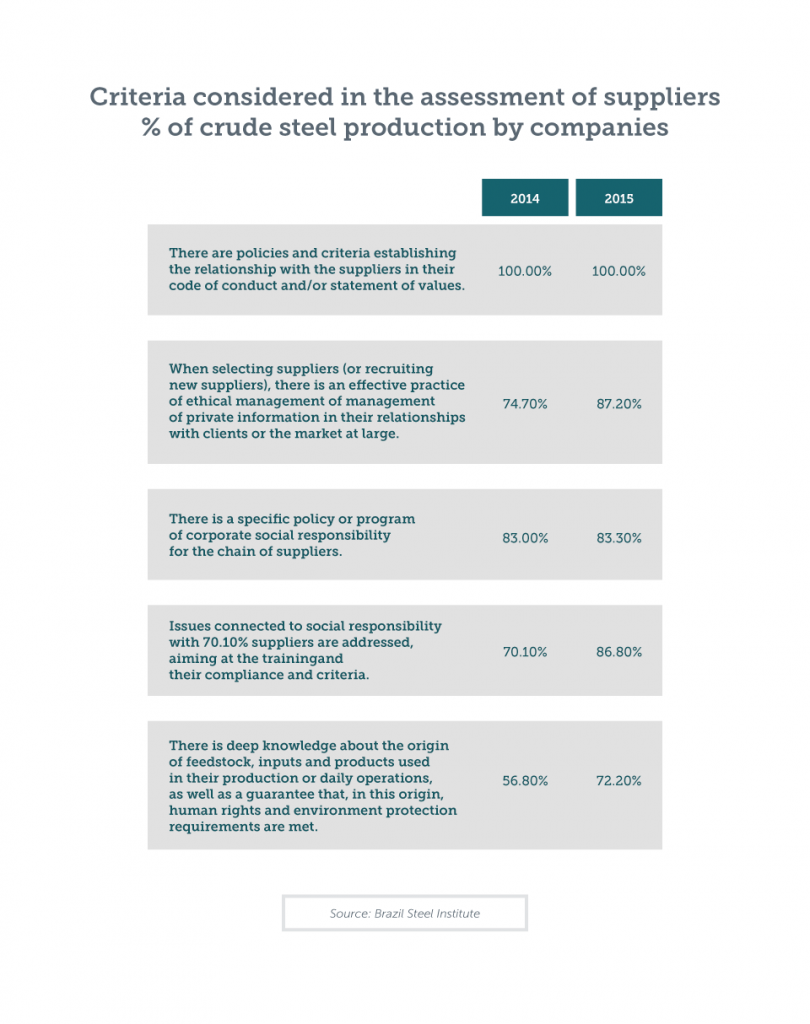

However, it is important to note that, despite such a difficult scenario, Brazilian steel production companies continue to meet standards of rational use of natural resources and feedstock, as well as to resort to operating technologies and practices that mitigate the impacts on the environment.

Similarly, the companies have strived to carry on with social responsibility projects in the cultural, professional qualification, health and income generation fields, to name a few.

Amid such relevant crisis in Brazil, we have been seeking to identify new opportunities. Firstly, we have been striving to ensure the survival of such an important industry to the economy of any country and, following to this, to resume growth, based on the belief in the creativity and entrepreneurship of our stakeholders.

We are confident that this crisis will be overcome through planning, hard work and ethical commitment. Each of us, Brazilians, is responsible for building up a future on par with the magnitude and strengths of our country. We trust this, and that is our tool to turn the game around.

Benjamin M. Baptista Filho

President of the Board of Directors of Brazil Steel Institute